Superhero Day!

Happy Mother’s Day to all the Mom’s who are reading PRIME PICK$ today. We all were brought in to this world by our Mom, and they are the real superheroes on an every day basis. Please take the time today to reach out to your Mom and send love and thanks for raising you!

We have another wild week on deck, along with OPEX this Friday. Last week we saw Jerome Powell emphasize that the FED is not cutting until there is a clear plan from Trump. We then saw Trump & Co. try and throw every make up piece of news possible at the market to keep it up. And as usual you find out the news is fake (like the UK deal that doesn’t exist!), and they start the next round of “hey look over here” tweets and media interviews.

Bessent is out today, along with Trump, claiming great progress in the China negotiations, and they will share details tomorrow. That right there is an immediate red flag to me, as it has been all along. This administration RACES to put out whatever “good” news they can come up with. If they had ANYTHING of significance to report, they would not need until tomorrow to write the narrative.

HOWEVER, the market seems to keep taking the bait. Keep in mind that “Liberation Day” was April 2. We were told “90 deals in 90 days”. It has been 39 days and there is not a single deal in place. I approach this week cautiously as I have been the last few weeks. I don’t believe the market can keep moving upwards without actual, factual, confirmed positive economic news.

But my thoughts are not how we trade. We trade off of charts, setups, and levels. Not “word salads”. We have another week packed with earnings, although they have had little impact on the market this quarter, instead being driven by news. Last week Trump also promised some “massive surprise” that he would share on “Thursday, Friday, or maybe Monday” before leaving for Saudi Arabia. We’ll see if there is any “major surprise” tomorrow…but don’t hold your breath!

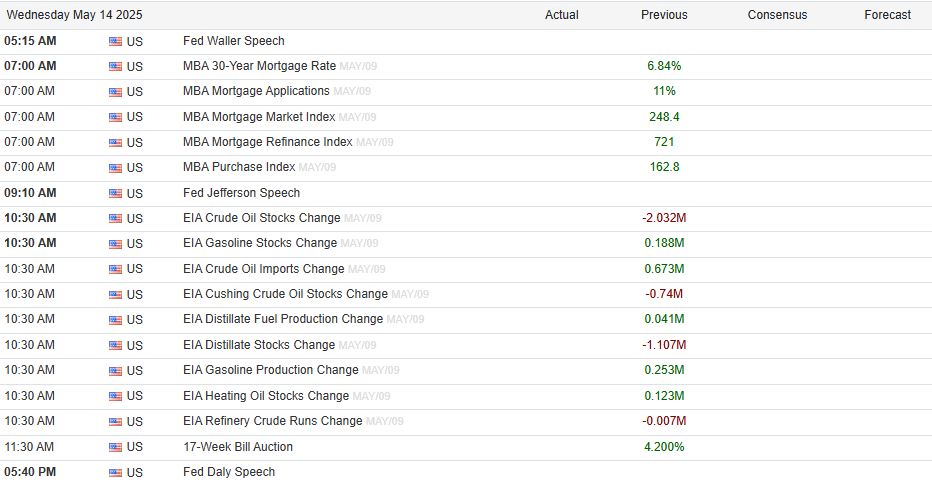

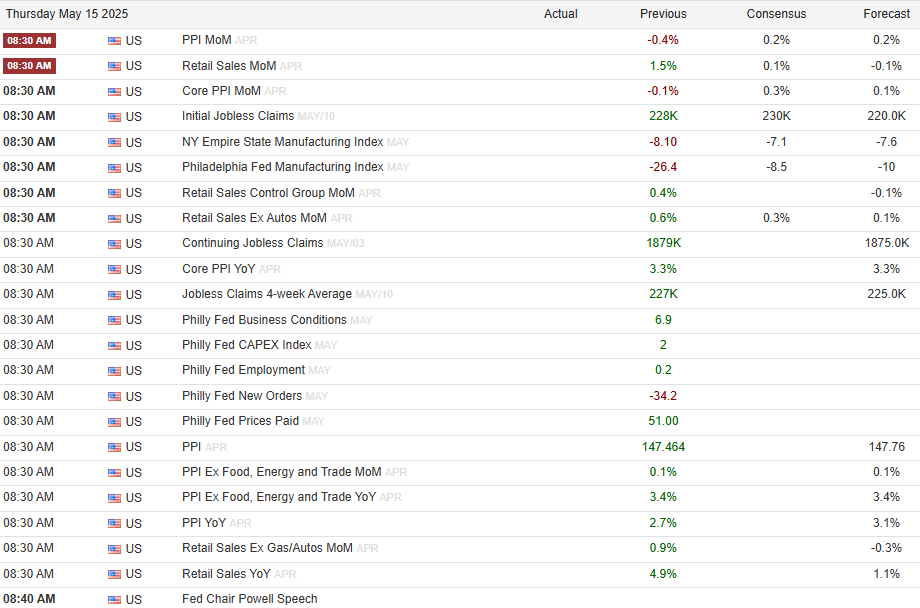

We also have inflation and CPI numbers Tuesday, along with Powell talking Thursday before market open. It is going to be a WILD week!

The Stack is loaded with charts, trade ideas, calendars, and Bonus Picks as always. Let’s get to the details for the upcoming week!

SUBSTACK CHAT IS LIVE!

For those who have not found your way on to the Substack app yet, I highly encourage you to do so. Since they implemented the chat feature we have been able to collaborate and drop info outside of the Stack publications, increasing the value of being a paid subscriber exponentially! Hop in today!

Annual Subscription Money Back Guarantee!!

If you don’t make back your ANNUAL subscription fee in 1 month, I will refund your money AND YOU KEEP your subscription.

ZERO RISK - WHO ELSE DOES THIS??

Valid on new annual subscriptions only. First month defined as first 8 issues from start of annual subscription.

My Charts

Over Green line = Entry for Calls

Under Red line = Entry for Puts

Dash/Dot Blue line = Price Targets

Orange Dash/Dot line = POC (Point Of Control)

Purple line = Dark Pool

Blue Boxes = Demand Zones

Red Boxes = Supply Zones

Price targets are not the same as option strikes.

Price targets are where I believe the chart can/will go.

The strikes I suggest are what I think provide the best risk/reward to make money.

Let’s BANK!

MARA

MARA 0.00%↑ daily with an inverse head & shoulders look to it heading in to Monday. Crypto has been hot, and there is a rumor floating this weekend that META may be adding crypto support to Facebook. This is one to keep an eye on. Cons are cheap and can run hard. Here’s the plan.

Calls over $16.35

17c & 17.5c on watch

PRIME STYLE: 5/23 19c

Puts under $15.50

15p & 14.5p on watch to the downside

DNUT

DNUT 0.00%↑ weekly bull flag setup is one that I am drooling over. This was trading over $10 to start the year. It is now under $3! But that drop has given us this retest of the lower trendline. Shares are cheap here, so that is on the table. I also have some long range ultra cheap ideas to consider.

Calls over $3.00

7/18 5c on watch

12/19 7.5c on watch

(both of these closed at .05 Friday…a push up on this name can see 10x-20x returns)

Puts under $2.60

2.5p on watch here

LMND

LMND 0.00%↑ weekly consolidating in this pennant formation. Closed the week rejecting the upper trendline, so the setup for this week is simple. We either push back up to try and break out of the trendline or we flush back lower and see if the lower trendline holds as support.

Calls over $31.50

32c & 33c on watch here

Puts under $30.00

29.5p & 29p on watch

SOFI

SOFI 0.00%↑ weekly bull flag looks juicy, and it’s another name with ultra cheap cons! Closing right underneath the upper trendline on Friday, we will look for continuation higher to break the trendline. Failure to breakout will see us head back towards the 11 area.

Calls over $13.50

14c & 14.5c on watch here

PRIME STYLE: 5/23 15c

Puts under $12.70

12.5p & 12p on watch

PRIME STYLE: 5/23 11p

MRK

MRK 0.00%↑ monthly falling wedge in to demand. One of my favorite chart setups. We can see major moves on a bounce from this area. Trump put out a tweet on Saturday with 8 companies listed on it, and MRK was one of them. No idea the intent of the tweet, but when he talks specific names it brings interest. Here’s the plan.

Calls over $77.00

79c & 80c on watch here

PRIME STYLE: 5/23 85c

Puts under $75.50

74p & 73p on watch

ORCL

ORCL 0.00%↑ weekly bull flag (yeah, that pattern is everywhere this week), closing below upper trendline, so you should know the drill by now. Breakout and go, or reject and flush. Here’s the plan.