Father’s Day, FOMC, and Fireworks Ahead

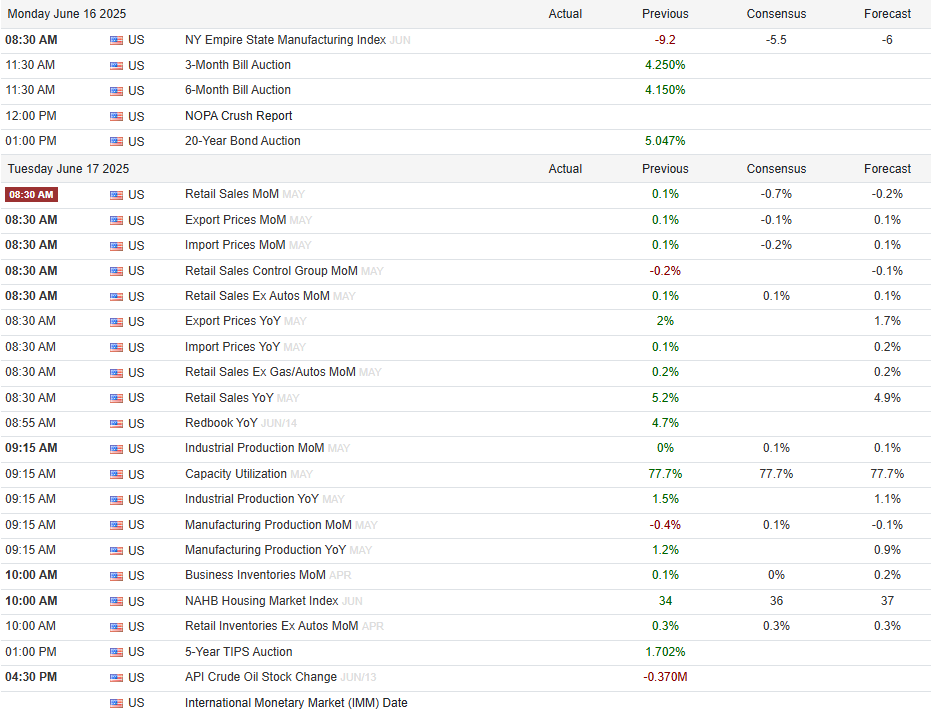

It’s Father’s Day. I want to take a moment to shout out my respect for the ones who show up, provide stability, and keep things from falling apart. Speaking of father figures, this week the markets will be watching Daddy Powell like a hawk (while hoping he’s a dove!). The FOMC meeting lands midweek, and traders everywhere will be hanging on every word, looking for clues, confirmations, or cracks in the Fed's tone.

This end of the week will be very difficult to trade, as the market will be closed this Thursday, for Juneteenth, before opening back up on Friday.

So Wednesday afternoon will be taken over by Powell, and that will roll in to Thursday being closed - please pay attention to swings/expirations/theta decay this week!

But that’s not the only pressure point. Over the weekend, Israel and Iran exchanged continued missile fire, escalating geopolitical risk right as we roll into a week already packed with catalysts. Volatility will be front and center. The VIX is likely to stay elevated, and options premiums are already reacting. This isn’t the kind of week to coast or trade on autopilot.

On top of that, we’ve got quarterly OPEX coming in hot—big flows, sharp rotations, and the potential for wild intraday swings as positions unwind or roll. This is the kind of environment that either pays you well for being prepared or punishes you for being sloppy.

Stay nimble. Stay aware. This is a big week, and the market isn’t in the mood for mistakes.

Jam packed edition tonight. Let’s get to the good stuff!

Annual Subscription Money Back Guarantee!!

If you don’t make back your ANNUAL subscription fee in 1 month, I will refund your money AND YOU KEEP your subscription.

ZERO RISK - WHO ELSE DOES THIS??

Valid on new annual subscriptions only. First month defined as first 8 issues from start of annual subscription.

My Charts

Over Green line = Entry for Calls

Under Red line = Entry for Puts

Dash/Dot Blue line = Price Targets

Orange Dash/Dot line = POC (Point Of Control)

Purple line = Dark Pool

Blue Boxes = Demand Zones

Red Boxes = Supply Zones

Price targets are not the same as option strikes.

Price targets are where I believe the chart can/will go.

The strikes I suggest are what I think provide the best risk/reward to make money.

Let’s BANK!

HD

HD 0.00%↑ daily rising channel (bear flag) setup for a very easy look to start tonight’s stack. This closed testing the lower trendline on Friday, we will look for a bounce from here to get in to calls, or a breakdown of the trendline for puts. Here’s my plan.

Calls over $357.00

360c & 362.5c on watch

PRIME STYLE: 365c

Puts under $353.00

347.5p & 345p on watch for puts

PRIME STYLE: 340p

ZIM

ZIM 0.00%↑ daily consolidating wedge formation. I really like this setup as the premiums will still be quite affordable in a sea of elevated premiums this week. Tight entries on this is what I’m looking at as we are at an inflection point, and the Middle East volatility will definitely put eyes on this name.

Calls over $17.75

18c & 18.5c on watch here

PRIME STYLE: 6/27 20c

Puts under $17.00

16.5p & 16p on watch here

UPST

UPST 0.00%↑ daily rising channel (bear flag) with the inverted hammer candle on Friday. This could be a sneaky runner this week as she is flush in the middle of this range. Buyers will look to protect $48.00 on the downside. Over $56.00 this really can start moving. Here’s the plan.

Calls over $53.00

55c & 56c on watch here

PRIME STYLE: 6/27 62c

Puts under $51.50

50p & 49p on watch

CVX

CVX 0.00%↑ is one of several oil names that will have a lot of attention, again because of the Middle East conflict. The daily broke the trendline Friday, before pulling back to end the day. The setup here is to hold over the trendline and attack the gap(s) above. Losing the trendline support can flush this back towards the POC.

Calls over $146.50

150c & 152.5c on watch here

PRIME STYLE: 6/27 160c

Puts under $144.50

143p & 142p on watch

NVO

NVO 0.00%↑ weekly bull flag with lots of room above to run. Increasing buyer volume the last 3 weeks, this is one to keep on watch. Simple setup: reject the trendline and flush lower you go puts, or breakout you can look at calls.

Calls over $81.75

82c & 83c on watch here

PRIME STYLE: 85c

Puts under $79.50

78p & 77p on watch

RTX

RTX 0.00%↑ daily with the breakaway hammer candle at all time high - this could keep going, as this is a contract defense name and, say it together, “Middle East conflict”. This sector will have more volume than usual this week, so here’s what I’m looking at.