Nuclear Summer

Half the year’s burned. The excuses should be too.

Missiles are flying, oil’s jumping, and volatility’s pulsing through the market like a live wire. While the world’s glued to war headlines and beach selfies, this is your moment to snap out of it.

Third quarter starts tomorrow.

Second half of the year.

Still time to fix your portfolio and rewrite the story if you stop chasing noise and not taking profits!

VIX is creeping, $UVXY starting to flicker. Crude’s catching headlines. The safe plays are rotating fast like defense, energy, gold, but this isn’t about chasing sectors. It’s about waking up. Everyone’s distracted. This is where the PRIME edge lives.

You can either watch from the shore or move like the waves.

The bombs might be falling over Iran, but the real explosions are what happens in your portfolio...

Prime Pick$ isn’t just the stack. It’s the mission.

You enlist to stop losing. You enlist to win.

And if you’re still on the fence? You’re already bleeding.

This summer is nuclear.

This stack is the war plan.

Don’t just survive it, weaponize it.

Welcome to Prime Pick$. Third quarter starts now. Let’s work.

Annual Subscription Money Back Guarantee!!

If you don’t make back your ANNUAL subscription fee in 1 month, I will refund your money AND YOU KEEP your subscription.

ZERO RISK - WHO ELSE DOES THIS??

Valid on new annual subscriptions only. First month defined as first 8 issues from start of annual subscription.

My Charts

Over Green line = Entry for Calls

Under Red line = Entry for Puts

Dash/Dot Blue line = Price Targets

Orange Dash/Dot line = POC (Point Of Control)

Purple line = Dark Pool

Blue Boxes = Demand Zones

Red Boxes = Supply Zones

Price targets are not the same as option strikes.

Price targets are where I believe the chart can/will go.

The strikes I suggest are what I think provide the best risk/reward to make money.

Let’s BANK!

COP

COP 0.00%↑ weekly bull flag kicks us off tonight. Oil names will be in focus as they were last week. The upper trendline has held as resistance for the past year and a half and we were unable to break out once again last week. Tomorrow we watch to see if there is a renewed attempt at a breakout, or if we head back towards the $90 area. Here’s my setup for this week.

Calls over $95.00

96c & 97c on watch

PRIME STYLE: 7/3 100c

Puts under $93.25

93p & 92p on watch for puts

AI

AI 0.00%↑ daily bear flag holding the lower trendline to close out on Friday. There has been a lot of selling on this name so far throughout June. I will be looking to hold the 23 level as sort of my line in the sand. You can try puts at $23.25, but $23.00 gives better confirmation.

Calls over $24.00

24.5c & 25c on watch here

PRIME STYLE: 26c

Puts under $23.25

23p & 22.5p on watch here

PRIME STYLE: 22p

HD

HD 0.00%↑ daily rising channel is set up for a bit upside move if it can hold the trendline support like it did Friday. You can even look to next week as 370-380 is possible with a little time on a bounce. A loss of the trendline support could send us all the way towards $330 area. Here’s the plan.

Calls over $351.25

357.5c & 360c on watch here

PRIME STYLE: 365c

Puts under $348.50

342.5p & 340p on watch

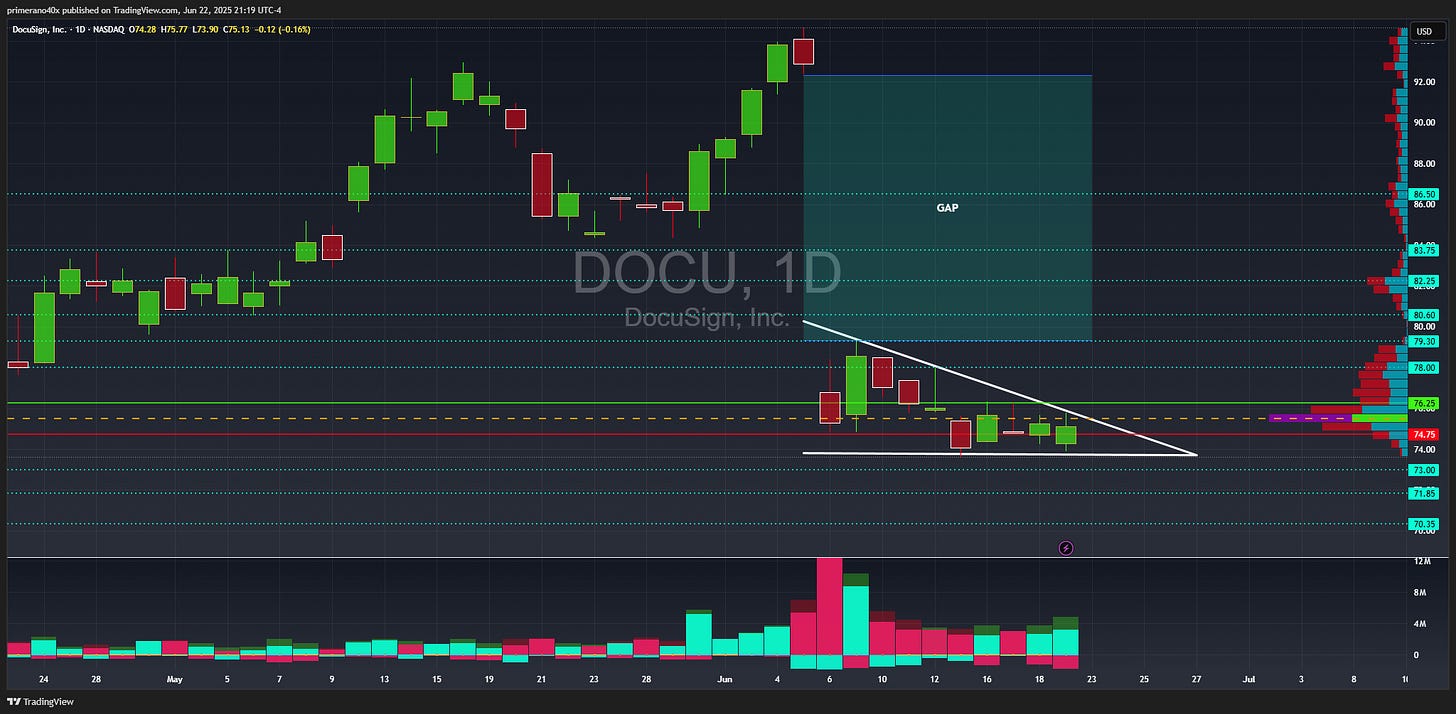

DOCU

DOCU 0.00%↑ daily descending triangle formation with that absolutely massive gap above. I would keep eyes on this as a breakout to the upside could produce massive returns. Here’s the plan.

Calls over $76.25

77c & 78c on watch here

PRIME STYLE: 80c

Puts under $74.75

74p & 73p on watch

CAT

CAT 0.00%↑ daily ascending triangle. 4 times this has rejected the breakout at the $364 area. It was the end of the quarter, so this week we will see if that price was artificially held down to close out the books, and if so this could rip towards the gap above. A breakdown of the trendline would have us hunting the $350 level.

Calls over $361.00

367.5c & 370c on watch here

PRIME STYLE: 385c

Puts under $358.75

352.5p & 350p on watch

PYPL

PYPL 0.00%↑ 4 hour bull flag is a nice setup for this week, with cheap cons to be had! Calls work here over Friday’s high of day at $70.55. A breakout could send this back towards the $75 level. Rejecting the trendline will have us headed towards $67.50 level.